Chicago aldermen discuss delayed payments, cash flow issues

(The Center Square) – A Chicago alderman is urging city officials to support legislation in Springfield that would require Cook County to reimburse local taxing districts for losses caused by the county’s delinquent distribution of property tax proceeds.

The Chicago City Council’s finance committee held a subject matter hearing on Monday to address the city’s cash flow situation and a delayed $260 million advance pension payment.

Chicago Budget Director Annette Guzman told the panel that Cook County is distributing funds without informing the city which taxing year the funds are from.

Guzman said the the city normally would have received the money last August, but payments have been delayed due to technological problems with the county’s tax system.

“I think, as of last Friday, we still are waiting on about $135 million in tax year 2024 from Cook County,” Guzman said.

Alderman Brendan Reilly encouraged Mayor Brandon Johnson’s legislative team to support Illinois House Bill 5241, filed by state Rep. Anthony DeLuca, D-Chicago Heights, and Senate Bill 3638, filed by state Sen. Kimberly Lightford, D-Maywood.

The companion measures would require Cook County to reimburse municipalities and other taxing districts for interest lost and debts incurred because of the county’s delinquent distributions.

“We’re talking about hundreds of millions of dollars in damage done by this failed tax system,” Reilly said.

Reilly is running for Cook County board president.

Alderman Gilbert Villegas said he looked forward to getting an ordinance in place for the city to collect outstanding revenue.

“We’ve got to find all the revenue needed before we even start talking about new revenue from taxpayers and from businesses,” Villegas said.

Acting Chicago Chief Financial Officer Steve Mahr said city officials are working diligently on debt sales and other existing revenue items in the budget.

On Tuesday, Mayor Brandon Johnson renewed his call to get a state constitutional amendment for a millionaire’s tax on the ballot.

“And then organizing around the state to ensure that that structural change takes place, that’s going to be the collective work of all of us,”

Even though voters rejected previous proposals for a graduated state income tax, the mayor said that does not preclude Illinois Democrats at every level of government from trying again.

“We are the people who have made a vow to working people,” Johnson said.

###

Event Calendar

Latest News Stories

Litchfield Switches Insurance Carriers to IML-RMA, Anticipates Savings and Lower Deductibles

Finance Committee: Spreadsheet Error Forces $1 Million Budget Correction; Committee Balances FY26 Plan

Litchfield Schools Earn “Commendable” Ratings; High School Nears Top Tier

Litchfield Limits Winter Lake Draw Down to 3 Feet, Citing Erosion and Water Quality Concerns

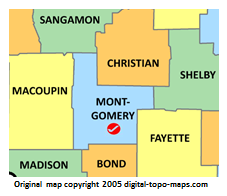

Meeting Summary and Briefs: Montgomery County Board for October 14, 2025

Litchfield School Board Sets Truth in Taxation Hearing, Estimates 9% Levy Increase

Construction Quality and Insurance Rates Addressed by County Board

Board Doubles Solar and Wind Application Fees, Rejects No-Bid Land Deal

Meeting Summary and Briefs: Litchfield Park District Board for Nov. 5, 2025

Meeting Summary and Briefs: Litchfield City Council for Nov. 6, 2025

Affrunti Resigns as State’s Attorney; Board Appoints Brian Shaw as Successor

City Restructures Finance Department, Hires Consultant and New Coordinator