Seahawks’ Super Bowl win temporarily jolts local Seattle economy

The Seattle Seahawks’ win over the New England Patriots in Super Bowl LX at Levi’s Stadium in Santa Clara, Calif., on Sunday is expected to cap a short-term boost to the Seattle economy that began when the team started its playoff run earlier this year.

There is some evidence to suggest that said effect is real, if temporary, particularly for retail, hospitality and restaurants, while driving up merchandise sales.

In 2025, the U.S. Chamber of Commerce put out a report with estimates of spending in the markets of last year’s Super Bowl participants, the Kansas City Chiefs and the Philadelphia Eagles.

“For the hometowns of each team, the Chamber estimates the Kansas City metro area could see $123.3 million in spending on the big game, while the Philadelphia metro could see $346.8 million,” the report states.

Seattle Metropolitan Chamber of Commerce President and CEO Joe Nguyen referenced last year’s Chamber of Commerce report in touting the Seahawks’ success translating into economic success for Seattle.

“Yes, this is true – a Seahawks Super Bowl appearance will likely deliver a real economic boost for Seattle!” he previously said in a statement emailed to The Center Square. “The U.S. Chamber of Commerce report from 2025 shows the Super Bowl drove hundreds of millions to more than $1 billion in spending nationwide, with increased demand for food, apparel, hospitality, and entertainment reaching cities like Seattle even when they aren’t hosting (Seattle’s estimated benefit in 2025 was $224,636,077).”

Victor Matheson, a professor of economics at the College of the Holy Cross in Worcester, Mass., is a widely recognized expert in the field of sports economics.

He referenced a 2002 paper by professors Dennis Coates and Brad Humphreys that found the city of the winning Super Bowl team experienced an increase of approximately $140 in real per capita personal income. This study suggested this economic impact was specific to the winning city, potentially linked to a “feel-good” effect or increased worker productivity.

“There was a paper written about 20 years ago that is a peer-reviewed paper with actual real data, so this isn’t, you know, totally made up, that suggested that teams that win the Super Bowl actually do experience an increase in per capita incomes over the course of the next year,” he told The Center Square in a phone interview. “The authors at least plausibly attribute that to happy workers are productive workers, and you get this little productivity boost from people being happy. And you don’t get the productivity boost from winning the MLS Cup, or winning the World Series, or the Stanley Cup, or any of these other things.”

Matheson noted that even the study’s authors were somewhat skeptical of reading too much into the results.

“But mind you, the authors themselves suggest it might have just been an artifact of the fact of how statistics work,” he said. “And when you test 100 different things, even if all those things are random, one of them is going to end up being the best, right?”

The Center Square asked Matheson about state Democratic lawmakers considering a new 9.9% income tax targeting high-earning athletes and performers making more than $1 million a year, often referred to as a “jock tax,” which would apply to both visiting and home teams based on “duty days” spent in the state.

“I don’t think we have a ton of evidence that suggests that places with higher taxes do worse on the field because of not being able to attract free agents,” he said.

Matheson did point to Shohei Ohtani’s 10-year, $700 million contract with the Los Angeles Dodgers that includes a massive deferred compensation structure – $680 million paid out between 2034 and 2043 – which allows him to avoid significant California state income taxes if he is no longer a California resident when the payments are made.

Ohtani can avoid the roughly 13.3% California income tax on the deferred portion by moving to a state with no income tax, such as Texas or Florida, or by returning to Japan before 2034, saving him an estimated $90 million to $98 million in taxes.

“This is certainly a plausible thing, and … there must be some amount that it’s easier to attract free agents to a Texas or a Florida rather than other places,” Matheson said.

Event Calendar

Latest News Stories

County Committee Considers Purchase of Hillsboro Building for Probation Expansion

WATCH: Reclaiming the Panama Canal could be back on the table

Las Vegas tourism industry continues to decline

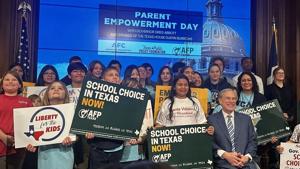

More states now offer school choice programs for families

Trump likely to make waves at biggest-ever World Economic Forum

Illinois House returns to session with plans for SAFE-T Act, Israel, taxes

Illinois quick hits: Bovino bounty trial to begin; Judge sentences Kentucky man to 15 years in drugs case; Pritzker criticizes Trump’s first year as Trump marks accomplishments

IL AG reviews battles vs. Trump administration: ‘365 days of chaos’

Largest U.S. band manufacturer plans to leave Ohio, send some production overseas

WATCH: Trump says he plans to send out $2,000 tariff checks without Congress

House to vote on last four govt. funding bills costing $1.2 trillion

Illinois House speaker, unions push millionaire’s tax as lawmakers return