Illinois House speaker, unions push millionaire’s tax as lawmakers return

(The Center Square) – Illinois state representatives are scheduled to be back in Springfield this week, and there is bipartisan concern over taxes.

The Illinois House’s first meeting of 2026 is set for Tuesday at 2:00 p.m.

Illinois House Speaker Emanuel “Chris” Welch, D-Hillside, said earlier this month he believes the state should tax rich people at higher rates.

“We should tax millionaires,” Welch said.

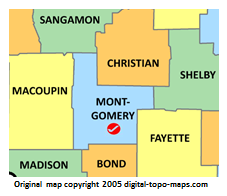

State Rep. Adam Niemerg, R-Dieterich, opposes further tax hikes and said he would prefer to see spending cuts.

“Unfortunately, Speaker Welch is talking about additional taxes. He’s teeing up additional taxes to tax more in the state of Illinois,” Niemberg told The Center Square.

State Rep. Anthony DeLuca, D-Chicago Heights, said lawmakers can’t just throw money at the same problems.

“If there’s going to be an attempt to raise additional revenue, however that’s going to look, in my opinion, it has to come with reforms,” DeLuca told TCS.

Activists and union leaders held a virtual “Tax the Rich” press briefing on Thursday.

Chicago Teachers Union and Illinois Federation of Teachers President Stacy Davis Gates said it is no longer good enough for Democrats to offer a tweet or a press conference.

“It is enough that working people get united across this country and demand that statehouses like ours in Springfield make billionaires pay their fair share,” Gates said.

At an unrelated event in Chicago on Friday, Gov. J.B. Pritzker said a millionaire’s tax would require a constitutional amendment that would originate and be placed on the ballot by the legislature.

The governor has said several times that he would favor a graduated income tax system.

“A millionaire’s tax would be something like that,” Pritzker said.

A TCS reporter asked Pritzker, a billionaire, how a millionaire’s tax might affect wealthy families.

“Honestly, I think in terms of their day-to-day lives, the wealthiest families in the state will not be affected in any way whatsoever. I’m not suggesting they’re not going to pay more in taxes if there’s a millionaire’s tax, but their ability to buy a home, to own a car, to get by every day to pay the bills, that isn’t something that they’re worrying about,” Pritzker said.

Gates said the teachers federation would be in Springfield Feb. 17, the day before the governor gives his budget address.

“And we’re going to deliver our letter to him saying, ‘Pay your fair share, just like the rest of the billionaires,’” Gates said.

Gates said the union would make its needs clear.

“We’re also going to talk to our allies and the families we serve and the students that we educate about what is fair, what is just and what we deserve,” Gates added.

Last November, former Illinois Gov. Pat Quinn proposed a 3% surcharge on incomes over $1 million.

In 2020, voters rejected of changing the state’s flat tax to a tax with higher rates for higher earners.

Greg Bishop contributed to this story.

Event Calendar

Latest News Stories

Illinois lawmaker questions IDHS over years-long data breach

Meeting Summary and Briefs: Litchfield Park District for Jan. 7, 2026

Board Hires Firm to Review Solar Farm Construction Documents

Registration Open for Food Safety Certification Course in Carlinville

Caden Jennings Graduates Basic Training, Joins Leitchfield Police

Probation Office Eying Purchase of North Main Street Property

Registration Open for In-Person Pesticide Testing in Carlinville and Hillsboro

Litchfield Firefighters Complete Advanced Building Comprehension Training

Pritzker signs Clean Slate Act to automatically seal some criminal convictions

Park Board Approves 2026 Events Calendar, Considers Kilton Fund Projects

Ad Hoc Committee Finalizes Recommendations for State Property Tax Study

Elite private colleges can’t cap off price-fixing collusion class action