Illinois House returns to session with plans for SAFE-T Act, Israel, taxes

(The Center Square) – Higher taxes, the SAFE-T Act and state policy regarding Israel may all be on the table as the Illinois House returns to business.

State representatives returned to Springfield on Tuesday for their first House session this year. The Illinois Senate met briefly last week.

Republican state Rep. Mike Coffey held a news conference at the Illinois Capitol to discuss a bill to amend the SAFE-T Act.

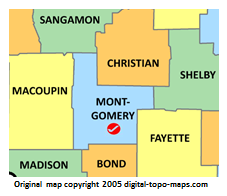

Coffey, R-Springfield, and state Rep. Wayne Rosenthal, R-Morrisonville, filed House Bill 4275.

Coffey said he discussed potential changes with Sangamon County State’s Attorney John Milhizer and Sangamon County Sheriff Paula Crouch.

“What we talked about was that felonies need to be detainable, all felonies, and then we need to give more judicial discretion so that we can make our communities much, much safer,” Coffey said.

Milhizer said HB 4275 would not be a complete overhaul of the SAFE-T Act.

“Bringing back cash bail, we don’t need to do it. We just need to make sure and ensure that in our communities, those individuals that are causing crime, that are making it more dangerous, are detained,” Milhizer said.

HB 4275 was assigned to the Illinois House Rules Committee last week.

State Rep. Adbelnasser Rashid, D-Bridgeview, held a news conference on Tuesday afternoon and proposed repealing a 2015 state law that allows corporate pension funds to boycott any state or country except Israel

“It removes us from punishing companies that boycott Israel. This actually brings us back to neutral,” Abdelnasser said.

Along with several activists and Democratic colleagues, Rashid said Illinois should remove itself from participating in what he called the oppression of the Palestinian people.

On the House floor, a Republican warned that Democrats are planning new tax hikes.

State Rep. Brad Halbrook, R-Shelbyville, said Illinois House Speaker Emanuel “Chris” Welch, D-Hillside recently claimed that the state does not have a spending problem but does need more revenue.

“If this is how we’re going to start the 2026 spring session, Illinois taxpayers should buckle up, because they’re about to pay for another round of bad decisions,” Halbrook said.

The Shelbyville Republican said Illinois policies of taxing, spending and borrowing led to record outmigration, empty storefronts and a shrinking middle class.

“Every time bad policy fails, the majority party reaches for the same solution: the taxpayer’s wallet. What’s next? The wallets of our retirees?” Halbrook asked.

House members are next scheduled to meet on Wednesday morning.

Event Calendar

Latest News Stories

Illinois lawmaker questions IDHS over years-long data breach

Meeting Summary and Briefs: Litchfield Park District for Jan. 7, 2026

Board Hires Firm to Review Solar Farm Construction Documents

Registration Open for Food Safety Certification Course in Carlinville

Caden Jennings Graduates Basic Training, Joins Leitchfield Police

Probation Office Eying Purchase of North Main Street Property

Registration Open for In-Person Pesticide Testing in Carlinville and Hillsboro

Litchfield Firefighters Complete Advanced Building Comprehension Training

Pritzker signs Clean Slate Act to automatically seal some criminal convictions

Park Board Approves 2026 Events Calendar, Considers Kilton Fund Projects

Ad Hoc Committee Finalizes Recommendations for State Property Tax Study

Elite private colleges can’t cap off price-fixing collusion class action