Op-Ed: The Supreme Court must stop Louisiana’s retroactive lawsuits

On Monday, the U.S. Supreme Court will hear oral arguments in Chevron v. Plaquemines Parish on a threshold jurisdictional question. The Court’s answer could have sweeping consequences for the energy industry and all federal contractors, determining whether such cases belong in federal court when defendants acted under federal direction.

Central to the case is the federal officer removal statute. Congress updated this statute over the decades, as recently as 2011 under President Barack Obama, no longer requiring a direct line of control and thereby recognizing the importance that such disputes be heard in federal, not state, courts. Accordingly, the Court should rule that the case properly belongs in federal court.

The case’s historical background is that during World War II, President Franklin D. Roosevelt effectively nationalized America’s energy industry (as he did others). At the time, the Petroleum Administration for War dictated almost every aspect of production, from the rig to the refinery to the railroads. Federal officials decided, among other things, how much crude oil to extract from Louisiana (more, more, more), the refineries to process it, how to distribute it, and what resources and products were needed for Allied victory, especially Avgas, a specialized type of high-octane aviation gasoline that was critical to Allied air power and victory and depended on Louisiana crude oil. Moreover, the federal government had the power to seize products and raw materials, repeatedly enlarge capacity, and increase production quotas at will. Thus, the government made America’s energy producers into its instruments of wartime policy and production in direct service of national defense, under extraordinary federal direction and supervision.

Accordingly, it is wrong and unfair for Louisiana and its municipalities, 80 years later, to sue American energy producers in Louisiana state courts for alleged environmental damage, especially when the local governments are deeply entwined and in cahoots with the plaintiffs’ attorneys, so much so that, in a perturbing surrender of Louisiana’s sovereignty to the plaintiffs’ attorneys, their contract prohibits Louisiana from endorsing any substantive defenses, even if legally valid.

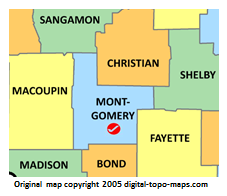

A traditional originalist approach shows that the statute’s plain text and Congress’s original intent of the statute and its 2011 amendment control, and that disputes involving private companies obeying federal government directives to produce critical wartime needs, are exactly what the statute intended to be heard in federal court. State or local governments cannot use their own state courts to second-guess or nullify federal policy and law, whether regarding defense, environmental, or something else. Additionally, the risk of conflict or bias in state court is too high because the state and local governments are parties to the litigation. For example, Louisiana Judge Michael Clement, Gov. Jeff Landry, and Attorney General Liz Murrill all received substantial campaign contributions from the plaintiffs’ attorneys and their associated PACs.

Thus, the Court’s decision will have ramifications not only for this case but also for environmental “lawfare” and other bogus lawsuits designed to bankrupt unpopular industries sprung from the unholy alliance of states, municipalities, and plaintiffs’ lawyers. This is especially true for any industry or company that touches upon national defense, which today is about half of all federal contracts. During World War II, the federal government conscripted many non-defense companies, in addition to the energy industry, to manufacture weapons and war equipment. Ford built almost half of all B-24 Liberator bombers, and Chrysler built tanks and B-26 Marauder and B-29 Superfortress bombers. General Motors, Underwood Typewriter, National Postal Meter, IBM, and Rock-Ola (jukeboxes and pinball machines) manufactured millions of M1 Carbines, and Singer Sewing Machine and Union Switch & Signal (railroad signaling equipment) manufactured 1911A1 pistols, among other things. Furthermore, this case will likely affect whether one state court’s rulings may effectively dictate other states’ and the nation’s policy choices, especially where Congress already spoke on the issue.

Paul Clement, the petitioners’ lawyer and former U.S. Solicitor General, correctly argued in his certiorari petition that the lawsuits against American energy producers are “an effort by local governments to obtain massive recoveries from companies that assisted the federal war effort long ago.” The Constitution created a federalist system precisely to prevent that kind of retroactive targeting. No one in 1942 thought that extracting, producing, refining, and transporting critical oil and petroleum products to win World War II would someday be alleged to be a violation of a state coastal statute for billions of dollars in damages.

The Supreme Court should reverse the Fifth Circuit and reaffirm what every generation of Congress and every prior Court has always understood: that when the federal government calls, those who answer deserve federal court protection from “state court proceedings that may reflect local prejudice.” The justices should ensure that logic and the law, not local politics, have the final word and that local courts may not rewrite America’s national interests generations after the fact.

Event Calendar

Latest News Stories

Lake Co. Circuit Clerk can’t undo $2.5M verdict for workers fired over politics

Illinois quick hits: McClain reports to prison

Op-Ed: How one puppy mill-teliant retailer is preempting local laws

Illinois quick hits: Chicago school board raises property tax levy

Illinois lawmaker welcomes possible Marine deployment after Supreme Court ruling

White business owners are biggest share of Illinois’ diversity-preferred contract group

Filings delayed in convicted ex-Illinois House speaker’s appeal

IL rep: As if Bears ‘had a plan to rob the bank’ before considering Indiana

County Committee Backs Circuit Clerk Contract; Wages Discussed for Sheriff’s Office Union

Probation Office Eyes Move to North Main Street; 127 N. Main Proposed for Purchase

Meeting Summary and Briefs: Litchfield Community Unit School District No. 12 for December 16, 2025

Meeting Summary and Briefs: Litchfield City Council for December 18, 2025