IL state lawmaker pushes back as analysis finds municipalities lost $10.9B

(The Center Square) – A new Illinois Policy Institute analysis estimates local governments have lost $10.9 billion since 2012 due to reduced state revenue sharing, prompting pushback from a state lawmaker.

The change stems from a decision more than a decade ago to lower the Local Government Distributive Fund, or LGDF, from 10% of state income tax revenues to less than 7%, a move that continues to squeeze city and town budgets statewide, according to state Rep. Steve Reick, R-Woodstock.

“It goes back to a deal made when Illinois adopted the income tax,” said Reick. “Local governments agreed not to impose their own income taxes in exchange for a guaranteed share of state revenue. When the state changed the percentage in 2012, municipalities were pushed to the back of the bus.”

Illinois Policy author Patrick Andriesen said the 2012 reduction was initially framed as temporary during a budget crisis under then-Gov. Pat Quinn, but the funding was never restored.

“The understanding at the time was that once the state got out of that tight spot, the share would go back to 10%,” Andriesen said.

According to the analysis, returning LGDF to 10% in 2024 alone would have sent roughly $1.17 billion more to municipalities. Instead, many local governments have turned to higher property taxes, fees and borrowing to cover basic services, according to Andriesen.

“The state took away revenue, then handed local governments the political heat,” Reick said. “People don’t yell at Springfield officials at the grocery store. They yell at their mayor.”

Reick said pension costs for police and fire have done nothing but increase, and those are non-negotiable.

“Home rule communities have more flexibility when it comes to raising revenue, but non-home rule municipalities have to go to referendum,” Reick said. “If the state isn’t going to step up, I wouldn’t oppose giving local governments limited home rule authority to address revenue needs and ease taxpayer fatigue.”

Andriesen said LGDF funding makes up about 25% of day-to-day municipal operations, leaving smaller communities especially vulnerable when state support declines.

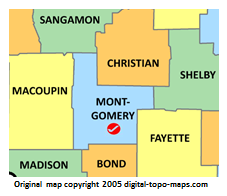

“Chicago can introduce new taxes and spread the cost across millions of people,” Andriesen said. “Smaller towns in central and southern Illinois don’t have that luxury. They’re reaching a boiling point.”

Some lawmakers have floated allowing municipalities to levy local income taxes. Andriesen said that approach would further strain residents.

“We’d just be feeding the fire,” he said. “Illinoisans are already paying some of the highest taxes in the country. Asking them to pay even more for the same services isn’t reform.”

Reick argued the issue reflects spending priorities at the state level, pointing to recent budget growth.

“We’re running a $50-plus billion state budget,” he said. “We spent about a billion dollars to insure illegal immigrants. That’s a billion dollars that could have gone to local governments to ease their suffering.”

Andriesen said restoring LGDF to its previous level would offer a direct path to property tax relief, if lawmakers are willing to give up control of the revenue.

“This was money meant to keep local taxes down,” Andriesen said. “Returning it would put resources closer to the people who know best how to use it and give taxpayers a real break.”

Event Calendar

Latest News Stories

Lake Co. Circuit Clerk can’t undo $2.5M verdict for workers fired over politics

Illinois quick hits: McClain reports to prison

Op-Ed: How one puppy mill-teliant retailer is preempting local laws

Illinois quick hits: Chicago school board raises property tax levy

Illinois lawmaker welcomes possible Marine deployment after Supreme Court ruling

White business owners are biggest share of Illinois’ diversity-preferred contract group

Filings delayed in convicted ex-Illinois House speaker’s appeal

IL rep: As if Bears ‘had a plan to rob the bank’ before considering Indiana

County Committee Backs Circuit Clerk Contract; Wages Discussed for Sheriff’s Office Union

Probation Office Eyes Move to North Main Street; 127 N. Main Proposed for Purchase

Meeting Summary and Briefs: Litchfield Community Unit School District No. 12 for December 16, 2025

Meeting Summary and Briefs: Litchfield City Council for December 18, 2025